Global

Dow Jones Global Index is headed for a test of resistance at 320 after penetrating its descending trendline. Respect of 320 is likely but a bottom is forming and a higher trough would suggest an inverted head-and-shoulders formation. 13-Week Twiggs Momentum recovery above zero is bullish but another low peak would indicate that bears still dominate.

North America

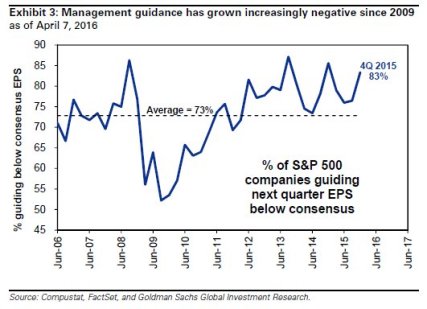

The S&P 500 continues to test the band of resistance at 2100 to 2130. Money Flow remains bullish but I expect stubborn resistance at this level, further strengthened by poor quarterly results, so far, in the earnings season.

A CBOE Volatility Index (VIX) at a low 14 indicates that (short-term) market risk is low. Long-term measures are also starting to ease but we maintain high cash levels in our portfolios.

Canada’s TSX 60 is headed for a test of resistance at 825. Penetration of the descending trendline suggests that a bottom is forming. Resistance is likely to hold but an ensuing higher trough would be a bullish sign. Rising 13-week Twiggs Momentum is encouraging but a low peak above zero would indicate that bears still dominate.

Europe

Germany’s DAX broke resistance at 10000 and is headed for a test of the descending trendline. Rising Money Flow indicates medium-term buying pressure. Retreat below 10000 would warn of another decline.

* Target calculation: 9500 – ( 11000 – 9500 ) = 8000

The Footsie is headed for a test of 6500. Rising Money Flow suggests decent buying pressure. Respect of resistance is likely but a bottom is forming and an ensuing higher trough would suggest a primary up-trend.

* Target calculation: 6000 – ( 6500 – 6000 ) = 5500

Asia

The Shanghai Composite Index retreated below 3000. Breach of medium-term support at 2900 would warn of another test of primary support at 2700. Rising Money Flow suggests that breach of primary support is unlikely.

* Target calculation: 3000 – ( 3600 – 3000 ) = 2400

Japan’s Nikkei 225 Index broke resistance at 17000, a higher trough signaling a primary up-trend. Expect retracement to test the new support level at 17000. Rising Money Flow confirms buying pressure.

* Target calculation: 17000 – ( 20000 – 17500 ) = 15000

India’s Sensex is testing its upper trend channel at 26000. Penetration of the descending trendline would suggest that a bottom is forming. Respect, indicated by reversal below 25000, would warn of another test of primary support.

* Target calculation: 23000 – ( 25000 – 23000 ) = 21000

Australia

A sharp fall in the Australian Dollar as result of record low inflation numbers may precipitate some selling by international buyers. Further weakness in iron ore would impact both the ASX and the Aussie Dollar.

The ASX 200 has also penetrated its descending trendline, suggesting that a bottom is forming. But bearish divergence on 13-week Money Flow warns of selling pressure. Retreat below 5000 would warn of another test of primary support at 4700.

* Target calculation: 4700 – ( 5200 – 4700 ) = 4200