“While many factors shape the economic outlook, some of the headwinds the U.S. economy faced in previous years have turned into tailwinds. Fiscal policy has become more stimulative and foreign demand for U.S. exports is on a firmer trajectory.”

~ New Fed Chair Jerome Powell in his first testimony before Congress

Two very important sentences for investors. Expect further rate hikes but at a moderate pace.

Bond yields have climbed in anticipation of higher inflation. Breakout above 3.0 percent would warn of a bond bear market, after the bull market of the last 3 decades, with rising yields.

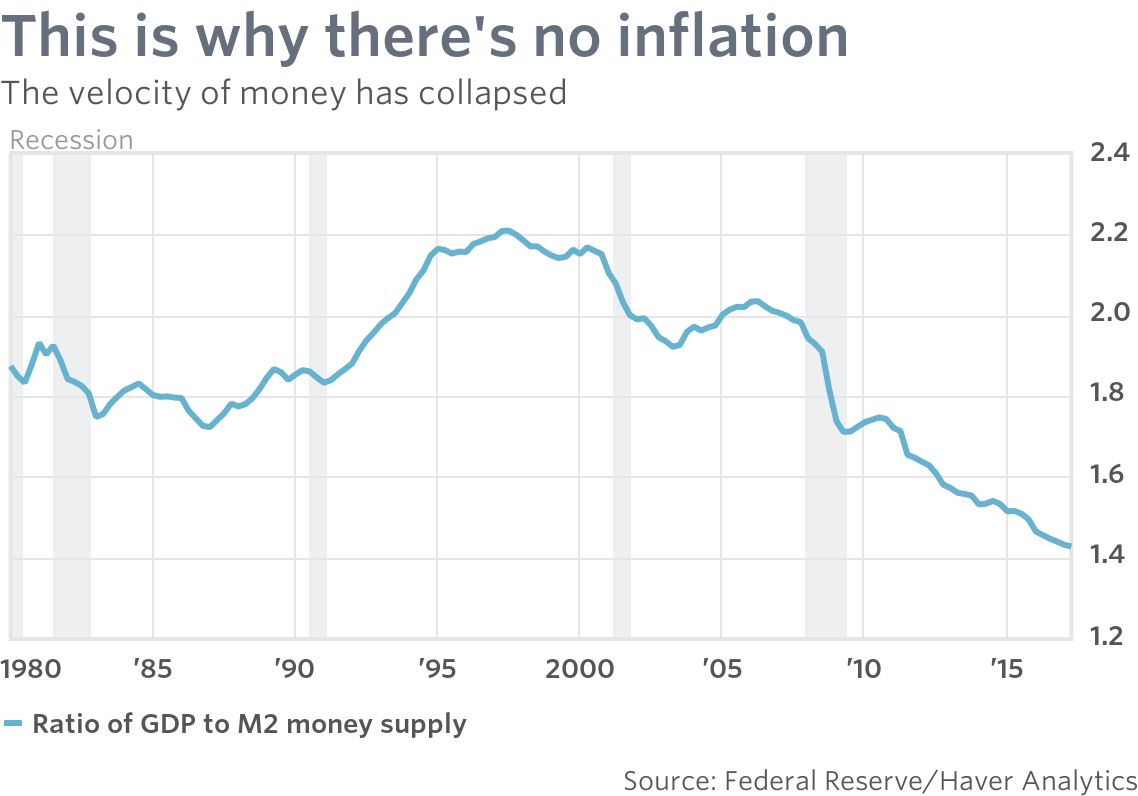

The five-year breakeven rate (Treasury yield minus the equivalent yield on inflation indexed TIPS) has been climbing since 2016.

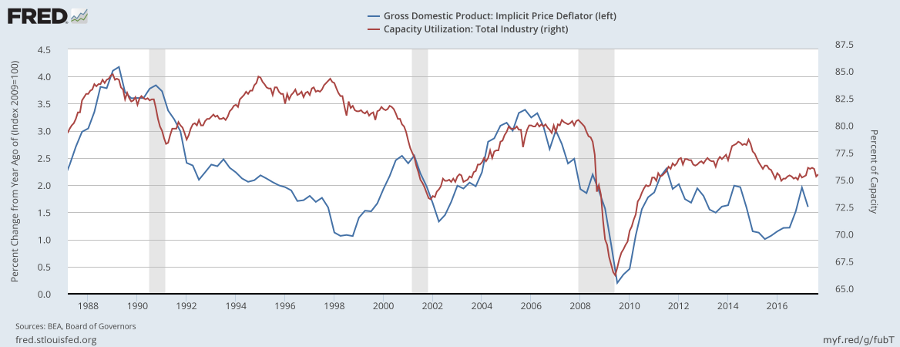

But core CPI (CPI less Food & Energy) remains subdued.

And average hourly wage rates, reflecting underlying inflationary pressures, continue to grow at a modest 2.5 percent a year.

Real GDP is likely to maintain its similarly modest growth.

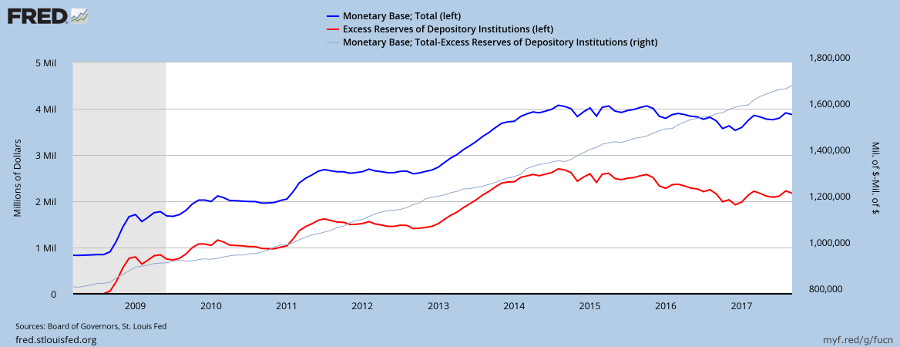

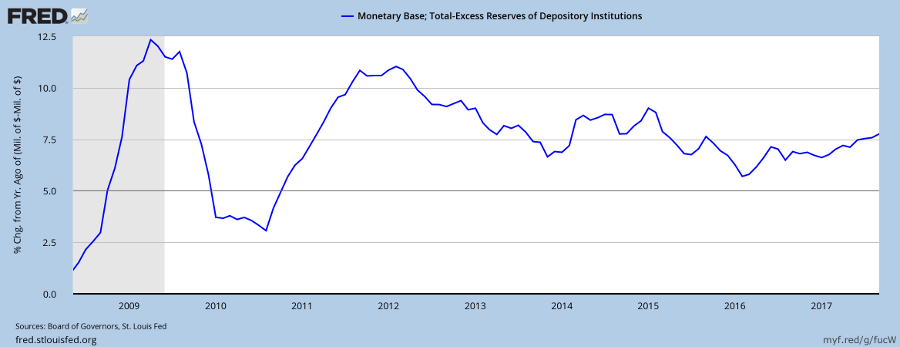

While the Fed is sitting on a powder keg of more than $2 trillion of commercial bank excess reserves, no one is playing with matches. Yet.

Those excess reserves on deposit at the Fed have the potential to fuel a massive bubble in stocks or real estate. But investors remain wary after their experience in 2008.

We should be careful to get out of an experience only the wisdom that is in it — and stop there; lest we be like the cat that sits down on a hot stove-lid. She will never sit down on a hot stove-lid again — and that is well; but also she will never sit down on a cold one anymore.

~ Samuel Clemens

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

You must be logged in to post a comment.