By Leith van Onselen. Reproduced with kind permission from Macrobusiness.

The Australian’s Adam Creighton has written a ripper post explaining why, in the wake of tax avoidance scandals (e.g. multinational and the Panama Papers), a broad-based land tax is needed more than ever, but will never see the light of day due to vested interests and weak politicians:

Windfall gains to private land owners stemming from developments outside their control are a far better object for taxation than income and consumption, which prop up vast avoidance industries…

Taxes on land are unique economically because they can’t be avoided and they don’t distort supply…

In fact, over time land tax (which should apply only to the unimproved part) could even reduce rents by encouraging development, including more apartments, on undeveloped land…

Land taxes may well be fairer, too. Just as the owners of land adjacent to new railway stations have done nothing to generate their windfall, land owners don’t lift a finger to generate increases in unimproved land values…

A comprehensive national, flat rate tax on unimproved land taxes was part of Labor’s platform from 1891 to 1905. The party should consider resurrecting this policy and using the proceeds entirely to slash personal income and/or company tax to unleash a productivity, investment and spending boom. This would help affordability; property prices would automatically fall…

A 1 per cent annual land tax without any exemptions could raise around $44bn based on the ABS’s estimates…

The economic ignorance and self-interest of land owners will, however, prevent any shift towards land tax, however beneficial it might be in the long run for almost everyone.

Vested interests would launch a hysterical defence of existing arrangements, wrongly claiming poor renters would be harmed.

Others would argue even stupid policies can’t be changed because some people have arranged their affairs around them.

Creighton has nailed it.

Land taxes are one of the most efficient sources of tax available, actually creating positive welfare gains to the domestic population of $0.10 for each dollar raised, since non-resident home owners are also taxed (see below Treasury chart).

Even just switching inefficient stamp duties (which cost the economy $0.70 per dollar raised) to a broad-based land tax would produce an estimated 1.5% increase in GDP, or $24 billion, without changing the amount of tax raised.

Unfortunately, while the arguments for shifting the tax base towards land taxes are impeccable, there are several key factors holding politicians back.

Consider the proposal to merely junk stamp duties in favour of a broad-based land tax levied on all land holders.

As shown by the RBA, only around 6% of the housing stock is transacted on average in a given year:

This means that in a given year, only a small minority of households pay stamp duty (albeit tens-of-thousands of dollars of dollars). And once they pay it, they automatically become a roadblock to reform (“why should I pay tax twice”, is the common retort).

While having such a small group of taxpayers supporting services for the whole community is ridiculous, rather than governments sharing the tax burden by levying each household a much smaller amount on a regular basis, it is far easier politically to tax a small group than everyone.

The other major roadblock with land taxes is that they would be levied on retirees that are asset (house) rich but cash poor. They would, therefore, squeal like stuffed pigs if they were required to pay tax.

The obvious solutions to these roadblocks are:

- To overcome concerns around “double taxation”, provide a credit to anyone that has purchased a home in the past 10 years, equal to the amount of stamp duty paid, and then subtract the hypothetical land tax that would have been paid since the home was purchased.

- Allow retirees to accumulate their land tax liability, with the bill payable upon death (via the estate) or once the house is eventually sold (whichever comes first), with interest charged on any outstandings.

However, even with such arrangements in place, politicians would still face the option of maintaining the status quo and taxing only a small number of people each year (easy) versus reforming and taxing almost everyone (hard).

Add in a fierce scare campaign from the property lobby – especially if land taxes were extended beyond just stamp duties to replace income taxes – and the likelihood of achieving meaningful reform is slim, especially with the current useless crop of politicians.

Citigroup (C) adds to banking woes

Citigroup (C) was the last of the bank heavyweights to release their first-quarter (Q1) 2016 earnings this week, reporting a sharp 27 percent fall in diluted earnings per share ($1.10) compared to the first quarter of last year ($1.51).

Revenues (net of interest) dropped 11% while non-interest expenses reduced by 3%. There was a modest 7% increase in the provision for credit losses (including benefits and claims). The fall in net revenues was largely attributable to a 27% decline in institutional business from Europe, Middle East & Africa (EMEA) and an 8% decline in North America. Consumer business also dropped in Latin America (13%) and Asia (9%).

Tier 1 Capital (CET1) improved to 12.3% (Q1 2015: 11.1%) of risk-weighted assets, while Leverage (SLR) improved to 7.4% (Q1 2015: 6.4%).

The dividend was held at 5 cents (Q1 2015: 5 cents), increasing the payout ratio to a parsimonious 5%, from 3% in Q1 2015.

C is in a primary down-trend, having broken primary support at $48. Long-term Momentum below zero confirms. Expect a rally to test resistance at $48 but respect is likely and would warn of another test of the band of primary support at $34 to $36. Breach would offer a target of the 2011 low at $24*.

* Target calculation: 36 – ( 48 – 36 ) = 24

We have had four heavyweights, JPM, BAC, WFC and C, all report declining earnings per share. Most had cut non-interest expenses but insufficient to compensate for falling revenues and rising provisions for credit losses.

It looks like we are on track for a tough earnings season.

Bank heavyweight earnings slip

Thursday was a big day for earnings releases, with two bank heavyweights reporting first-quarter (Q1) 2016 earnings.

Bank of America (BAC)

Bank of America reported a 19 percent fall in earnings per share ($0.21) compared to the first quarter of last year ($0.26). The fall was largely attributable to a drop in investment banking and trading profits. Provision for credit losses increased 30% for the quarter, to $997 million.

Tier 1 Capital (CET1) improved to 11.6% (Q1 2015: 11.1%) of risk-weighted assets, while Leverage (SLR) improved to 6.8% (Q1 2015: 6.4%).

The dividend was held at 5 cents (Q1 2015: 5 cents), increasing the payout ratio to a modest 24%, from 19% in Q1 2015.

BAC is in a primary down-trend, having broken primary support at $15. Long-term Momentum below zero confirms. Expect a rally to test resistance at $15 but this is likely to hold and respect would warn of another decline, with a target of $9*.

* Target calculation: 12 – ( 15 – 12 ) = 9

Wells Fargo (WFC)

Wells Fargo reported a 5 percent fall in (diluted) earnings per share ($0.99) compared to the first quarter of last year ($1.04). Provision for credit losses increased 78% for the quarter, to $1.09 billion, primarily due to exposure to the Oil & Gas sector.

Tier 1 Capital (CET1) improved to 10.6% (Q1 2015: 10.5%) of risk-weighted assets. No leverage ratio was provided..

The dividend of 37.5 cents is up on Q1 2015 dividend of 35 cents, increasing the payout ratio to 38% from 34% in Q1 2015.

WFC is in a primary down-trend, having broken primary support at $48. Long-term Momentum below zero confirms. Expect a rally to the descending trendline but respect is likely and reversal below $48 would warn of another decline, with a target of $40*.

* Target calculation: 48 – ( 56 – 48 ) = 40

So far we have had three heavyweights, JPM, BAC and WFC all report similar performance: declining earnings per share despite deep cuts in non-interest expenses, partly attributable to rising provisions for credit losses.

Citigroup (C) is due to report Friday 11:00 am EST.

JP Morgan earnings dip but stock rallies

First of the financial heavyweights to report first-quarter (Q1) earnings this week, JP Morgan (JPM) reported a 7 percent fall in earnings per share ($1.36) compared to the first quarter of last year ($1.46). The fall was largely attributable to a 90 percent increase in provision for credit losses for the quarter, to $1.8 billion, primarily from a sharp increase in net charge-offs in the Consumer division but also exposure to Oil & Gas and Metals & Mining in Investment Banking.

Tier 1 Capital (CET1) improved to 11.8% (Q1 2015: 10.7%) of risk-weighted assets, while Leverage (SLR) improved to 6.6% (Q1 2015: 5.7%).

The dividend was held at 44 cents (Q1 2015: 40 cents), increasing the payout ratio to a modest 32% from 27% in Q1 2015.

The monthly chart shows long-term Momentum is slowing, with JPM forming a broad top above $54. Declining peaks since August 2015 warn of a primary down-trend and breach of $54 would confirm, offering a target of $40*.

* Target calculation: 55 – ( 70 – 55 ) = 40

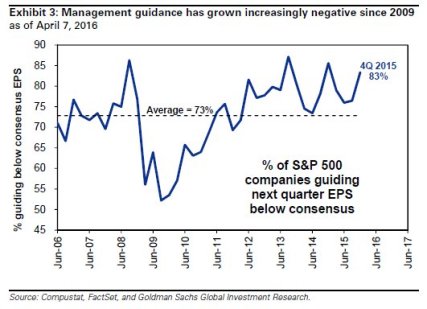

The market responded well to ‘positive’ news that JPM beat its earnings estimate, boosting the stock by 4.6%. This is a game we will see a lot more of this year: give really low guidance if you expect a bad quarter. When the result comes out, the gullible will focus on the fact that you beat your estimate rather than that your earnings are falling. This chart from Zero Hedge shows the rising percentage of companies guiding next quarter earnings below consensus:

Don’t be mis-led by the latest ‘froth’. The reality for the banking sector is net interest margins are near record lows and credit losses are rising.

Bullish in 2015:

– Rising earnings

– Falling oil

– Rate hikesBullish in 2016:

– Falling earnings

– Rising oil

– No rate hikes— Northy (@NorthmanTrader) April 11, 2016

Surprise fall in Consumer Sentiment | Westpac

The Westpac Melbourne Institute Index of Consumer Sentiment fell by 4.0% in April from 99.1 in March to 95.1 in April.

Not a good time to buy stocks — other than gold — I suggest.

Low interest rates and secular stagnation

Interesting observation by Pierre-Olivier Gourinchas, a research associate at the NBER:

In recent theoretical work, Caballero, Farhi, and I show that the safe-asset scarcity mutates at the ZLB [Zero Lower Bound], from a benign phenomenon that depresses risk-free rates to a malign one where interest rates cannot equilibrate asset markets any longer, leading to a global recession. The reason is that the decline in output reduces net-asset demand more than asset supply. Hence our analysis predicts the emergence of potentially persistent global-liquidity traps, a situation that actually exists in most of the advanced economies today.

…..our results point to a modern — and more sinister — version of the Triffin dilemma. As the world economy grows faster than that of the U.S., so does the global demand for safe assets relative to their supply. This depresses global interest rates and could push the global economy into a persistent ZLB environment, a form of secular stagnation.

Source: The Structure of the International Monetary System | NBER

APRA waves wet lettuce at bank offshore funding | MacroBusiness

From Leith van Onselen at Macrobusiness:

…..the banks’ reliance on offshore funding hit an unprecedented 54% of GDP in the December quarter:

As always, the key risk is that the banks’ ability to continue borrowing from offshore rests with foreigners’ willingness to continue extending them credit. This willingness will be tested in the event that Australia’s sovereign credit rating is downgraded (automatically downgrading the banks’ credit ratings), there is another global shock, or a sharp deterioration in the Australian economy (raising Australia’s risk premia).

The Federal Budget, too, is now hostage to the banks’ offshore borrowing binge as it cannot borrow to spend on infrastructure or other initiatives for fear that Australia will lose its AAA credit rating, potentially leading to an unraveling of the private debt bubble created by Australia’s banks.

That APRA could stand by and allow the banks’ to borrow externally like drunken sailors is a hallmark of regulatory failure.

One in four dollars of bank assets is funded by offshore borrowing. A precarious position even for a stable economy (like Ireland?), let alone one hitched to the boom and bust commodity cycle. Smacks of moral hazard by the banks.

Source: APRA waves wet lettuce at bank offshore funding – MacroBusiness

The future of Chinese steel | MacroBusiness

From Andrew Batson’s interview with Cai Rang, chairman of the China Iron & Steel Research Institute Group:

China’s current steel production capacity is 1.2 billion tons, but domestic demand cannot completely absorb this capacity. In 2015 China exported about 100 million tons of steel products; this was a relief for domestic capacity but a shock to the international market. Already nine European countries have made antidumping complaints, and Japan, Korea and India have also complained. This shows that our country’s current steel production capacity is not sustainable, and must be genuinely reduced.

Now the relevant departments are drafting the 13th five-year plan for the iron and steel industry, and the preliminary plan is to first cut 200 million tons, and eventually stabilize steel capacity around 700 million tons.

How will a 40 percent cut in Chinese steel production impact on Australian iron ore exports? Not well, I suspect.

Headmaster Turnbull takes cane to banks

Elizabeth Knight quotes prime minister Malcolm Turnbull speaking at Westpac’s 199th birthday lunch:

Meanwhile Turnbull – himself a former head of the Australian chapter of Goldman Sachs – told those attending the Westpac lunch that bank culture must shift from one that traditionally had been all about profit to one that took into account broader social responsibility.

Remuneration and promotion cannot any longer be based solely on direct financial contribution to the bottom line.

While bank bosses have been talking the same kind of talk for a while now, the growing number of instances where the behaviour of the banks had fallen short as a result of the drive to increase profit (and personal bonuses derived from making returns) are becoming harder to explain away using the excuse of a few bad apples.

“We expect our bankers to have higher standards, we expect them always, rigorously, to put their customers’ interests first – to deal with their depositors and their borrowers, with those they advise and those with whom they transact in precisely the same way they would have them deal with them,” he said.

Turnbull has hit on a key risk area for banks: remuneration structures that reward short-term profit objectives promote a risk-taking culture. Bank deals often look impressive at the start only to sour later. Incentives that encourage employee share purchases align staff interests with those of shareholders — a prudent, long-term outlook — while share options and bonus schemes encourage a short-term focus, aggressive risk-taking and divisional rivalry that can damage long-term value.

APRA may consider remuneration structures as outside their risk management ambit but it is time for a re-think. Toxic management culture is the biggest risk of all.

“Only when the tide goes out do you discover who’s been swimming naked.” ~ Warren Buffett

Source: Headmaster Malcolm Turnbull takes cane to banks leaving Westpac management ginger

RBA leaves official cash rate at 2pc

Jens Meyer quotes RBA governor Glenn Stevens:

While the decision to keep rates unchanged was widely expected, analysts were speculating that the governor would show some concern about the recent steep rise in the Australian dollar’s exchange rate, which gained nearly 12 per cent from its January lows to a peak of US77.23¢ last week.

Mr Stevens duly added a paragraph to this month’s statement, noting that the currency had appreciated “somewhat”.

“In part, this [the recent rise] reflects some increase in commodity prices, but monetary developments elsewhere in the world have also played a role,” he said, referring to recent monetary easing by other central banks including the Bank of Japan and the European Central Bank, as well as the decision by the US Federal Reserve to reduce the pace of interest rate hikes.

“Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy,” he added.

But anyone hoping for a stronger “jawbone” was disappointed and the Australian dollar shot up by about half a cent to the day’s high of US76.32¢, before falling back in late trade to around US76¢.

Central banks around the globe are destabilizing financial markets and the RBA responds with a polite acknowledgement at the end of its statement. Someone please tell the governor: If you want to run with the big dogs, you’ve got to learn to pee high.

You must be logged in to post a comment.