Economic Policy Institute President Lawrence Mishel provides the U.S. House Committee on Education and the Workforce with a shopping list of measures he believes are necessary to achieve full employment. Some are right on the mark while others seem to have missed the basic rules of Supply and Demand taught in Econ 101. My comments are in bold.

Jobs

Policies that help to achieve full employment are the following:

1. The Federal Reserve Board needs to target a full employment with wage growth matching productivity.

The most important economic policy decisions being made about job growth in the next few years are those of the Federal Reserve Board as it determines the scale and pace at which it raises interest rates. Let’s be clear that the decision to raise interest rates is a decision to slow the economy and weaken job and wage growth. There are many false concerns about accelerating wage growth and exploding inflation based on the mistaken sense that we are at or near full employment. Policymakers should not seek to slow the economy until wage growth is comfortably running at the 3.5 to 4.0 percent rate, the wage growth consistent with a 2 percent inflation target (since trend productivity is 1.5 to 2.0 percent, wage growth 2 percent faster than this yields rising unit labor costs, and therefore inflation, of 2 percent). The key danger is slowing the economy too soon rather than too late.

Fed monetary policy should not target one sector of the economy (i.e. wages) but the whole economy (i.e. nominal GDP).

2. Targeted employment programs

Even at 4 percent unemployment, there will be many communities that will still be suffering substantial unemployment, especially low-wage workers and many black and Hispanic workers. To obtain full employment for all, we will need to undertake policies that can direct jobs to areas of high unemployment……

Government programs don’t create jobs, they merely redistribute income from the taxed to the subsidised.

3. Public investment and infrastructure

There is widespread agreement that we face a substantial shortfall of public investment in transportation, broadband, R&D, and education. Undertaking a sustained (for at least a decade) program of public investment can create jobs and raise our productivity and growth…..

Agree. But we must invest in productive assets that generate income that can be used to repay the debt. Else we are left with a pile of debt and no means to repay it.

Policies that do not help us reach full employment include:

1. Corporate tax reform

There are many false claims that corporate tax reform is needed to make us competitive and bring us growth. First off, the evidence is that the corporate tax rates U.S. firms actually pay (their “effective rates”) are not higher than those of other advanced countries. Second, the tax reform that is being discussed is “revenue neutral,” necessarily meaning that tax rates on average are actually not being reduced; for every firm or sector that will see a lower tax rate, another will see a higher tax rate. It is hard to see how such tax reform sparks growth.

Zero-sum thinking. If we want to increase employment, we need to increase investment. Tax rates and allowances should encourage domestic investment rather than offshore expansion.

2. Cutting taxes

There will surely be many efforts in this Congress to cut corporate taxes and reduce taxes on capital income (e.g., capital gains, dividends) and individual marginal tax rates, especially on those with the highest incomes. It’s easy to see how those strategies will not work….

Same as above. We need to encourage investment by private corporations.

3. Raising interest rates

There are those worried about inflation who are calling on the Federal Reserve Board to raise interest rates soon and steadily thereafter. Their fears are, in my analysis, unfounded. But we should be clear that those seeking higher interest rates are asking our monetary policymakers to slow economic growth and job creation and reflect a far-too-pessimistic assumption of how far we can lower unemployment, seemingly aiming for unemployment at current levels or between 5.0 and 5.5 percent….

Agreed. Raising interest rates too soon is as dangerous as raising too late.

Wage growth

It is a welcome development that policymakers and presidential candidates in both parties have now acknowledged that stagnant wages are a critical economic challenge…… Over the 40 years since 1973, there has been productivity growth of 74 percent, yet the compensation (wages and benefits) of a typical worker grew far less, just 9 percent (again, mostly in the latter 1990s)……

Wage stagnation is conventionally described as being about globalization and technological change, explanations offered in the spirit of saying it is caused by trends we neither can nor want to restrain. In fact, technological change has had very little to do with wage stagnation. Such an explanation is grounded in the notion that workers have insufficient skills so employers are paying them less, while those with higher wages and skills (say, college graduates) are highly demanded so that employers are bidding up their wages…….

Misses the point. Technology has enabled employers in manufacturing, finance and service industries to cut the number of employees to a fraction of their former size.

Globalization has, in fact, served to suppress wage growth for non-college-educated workers (roughly two-thirds of the workforce). However, such trends as import competition from low-wage countries did not naturally develop; they were pushed by trade agreements and the tolerance of misaligned and manipulated exchange rates that undercut U.S. producers.

This small paragraph hits on the key reason for wage stagnation in the US. Workers are not only competing in a global labor market, but against countries who have manipulated their exchange rate to gain a competitive advantage.

There are two sets of policies that have greatly contributed to wage stagnation that receive far too little attention. One set is aggregate factors, which include factors that lead to excessive unemployment and others that have driven the financialization of the economy and excessive executive pay growth (which fueled the doubling of the top 1 percent’s wage and income growth). The other set of factors are the business practices, eroded labor standards, and weakened labor market institutions that have suppressed wage growth. I will examine these in turn.

Aggregate factors

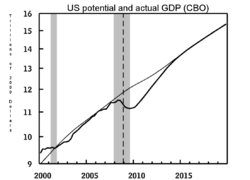

1. Excessive unemployment

Unemployment has remained substantially above full employment for much of the last 40 years, especially relative to the post-war period before then. Since high unemployment depresses wages more for low-wage than middle-wage workers and more for middle-wage than high-wage workers, these slack conditions generate wage inequality. ……

The excessive unemployment in recent decades reflects a monetary policy overly concerned about inflation relative to unemployment and hostile to any signs of wage growth……

2. Unleashing the top 1 percent: finance and executive pay

The major forces behind the extraordinary income growth and the doubling of the top 1 percent’s income share since 1979 were the expansion of the finance sector (and escalating pay in that sector) and the remarkable growth of executive pay …… restraining the growth of such income will not adversely affect the size of our economy. Moreover, the failure to restrain these incomes leaves less income available to the vast majority……

Zero-sum thinking.

Labor standards, labor market institutions, and business practices

There are a variety of policies within the direct purview of this committee that can greatly help to lift wage growth:

1. Raising the minimum wage

The main reason wages at the lowest levels lag those at the middle has been the erosion of the value of the minimum wage, a policy undertaken in the 1980s that has never fully been reversed. The inflation-adjusted minimum wage is now about 25 percent below its 1968 level……

Will reduce demand for domestic labor and increase demand for offshoring jobs.

2. Updating overtime rules

The share of salaried workers eligible for overtime has fallen from 65 percent in 1975 to just 11 percent today……

This will continue for as long as the manufacturing sector is white-anted by offshoring jobs.

3. Strengthening rights to collective bargaining

The single largest factor suppressing wage growth for middle-wage workers over the last few decades has been the erosion of collective bargaining (which can explain one-third of the rise of wage inequality among men, and one-fifth among women)……

How will this improve Supply and Demand?

4. Regularizing undocumented workers

Regularizing undocumented workers will not only lift their wages but will also lift wages of those working in the same fields of work…..

How will this improve Supply and Demand?

5. Ending forced arbitration

One way for employees to challenge discriminatory or unfair personnel practices and wages is to go to court or a government agency that oversees such discrimination. However, a majority of large firms force their workers to give up their access to court and government agency remedies and agree to settle such disputes over wages and discrimination only in arbitration systems set up and overseen by the employers themselves…..

How will this improve Supply and Demand?

6. Modernizing labor standards: sick leave, paid family leave

We have not only seen the erosion of protections in the labor standards set up in the New Deal, we have also seen the United States fail to adopt new labor standards that respond to emerging needs……

No issue with this. But how will it improve Supply and Demand?

7. Closing race and gender inequities

Generating broader-based wage growth must also include efforts to close race and gender inequities that have been ever present in our labor markets…….

No issue with this. But how will it improve Supply and Demand?

8. Fair contracting

These new contracting rules can help reduce wage theft, obtain greater racial and gender equity and generally support wage growth……

No issue with this. But how will it improve Supply and Demand?

9. Tackling misclassification, wage theft, prevailing wages

There are a variety of other policies that can support wage growth. Too many workers are deemed independent contractors by their employers when they are really employees……

No issue with this. But how will it improve Supply and Demand?

Policies that will not facilitate broad-based wage growth

1. Tax cuts: individual or corporate

The failure of wages to grow cannot be cured through tax cuts. Such policies are sometimes offered as propelling long-run job gains and economic growth (though they are not aimed at securing a stronger recovery from a recession, as the conservatives who offer tax cuts do not believe in counter-cyclical fiscal policy). These policies are not effective tools to promote growth, but even if they did create growth, it is clear that growth by itself will not lift wages of the typical worker…….

Zero-sum thinking. Compare economic growth in high-tax countries to growth in low tax countries and you will find this a highly effective policy tool.

2. Increasing college or community college completion

……advancing education completion is not an effective overall policy to generate higher wages……. What is needed are policies that lift wages of high school graduates, community college graduates, and college graduates, not simply a policy that changes the number of workers in each category.

Better available skills-base leads to increased competitiveness in global labor market and more investment opportunities in the domestic market.

3. Deregulation

There is no solid basis for believing that deregulation will lead to greater productivity growth or that doing so will lead to wage growth. Deregulation of finance certainly was a major factor in the financial crisis and relaxing Dodd–Frank rules will only make our economy more susceptible to crisis.

What we need is (simple) well-regulated markets rather than (complex) over-regulation.

4. Policies to promote long-term growth

Policies that can substantially help reduce unemployment in the next two years are welcomed and can serve to raise wage growth. Policies aimed at raising longer-term growth prospects may be beneficial but will not help wages soon or necessarily lead to wage growth in future years. This can be seen in the decoupling of wage growth from productivity over the last 40 years. Simply increasing investments and productivity will not necessarily improve the wages of a typical worker. What is missing are mechanisms that relink productivity and wage growth. Without such policies, an agenda of “growth” is playing “pretend” when it comes to wages.

Long-term investment is the only way forward. To dismiss this in favor of short-term band-aid solutions is nuts!

You must be logged in to post a comment.