The Nasdaq 100 continues its accelerating up-trend — as indicated by successively steeper trendlines and a rising trendline on 13-week Twiggs Momentum. Accelerating trends, or blow-offs, are well-known for rapid gains but inevitably end with a sharp fall.

* Target calculation: 2900 + ( 2900 – 2500 ) = 3400

The CBOE Volatility Index (VIX) remains below 15, indicating low market risk.

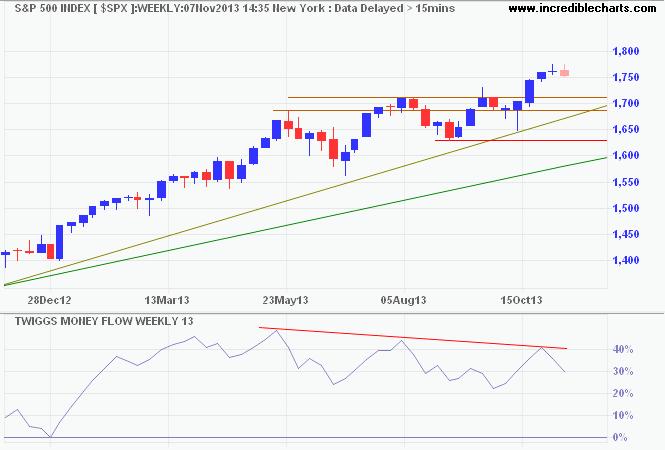

The S&P 500 is edging higher on the weekly chart, but bearish divergence on 13-week Twiggs Money Flow warns of rising selling pressure. Reversal below the secondary trendline at 1700 would indicate a correction to the primary trendline and primary support at 1630.

* Target calculation: 1730 + ( 1730 – 1650 ) = 1810

Dow Jones Industrial Average is testing resistance at 15700. Breakout would offer a target of 16600*. Respect of the descending trendline on 13-week Twiggs Money Flow, however, would confirm the earlier bearish divergence and warn of a correction to primary support at 14800. Breach of 14800 remains unlikely, but would signal a reversal.

* Target calculation: 15700 + ( 15700 – 14800 ) = 16600

Canada’s TSX 60 is retracing after a strong spurt. Duration of retracements reflect trend strength. Another trough above zero on 13-week Twiggs Money Flow would suggest strong buying pressure. Reversal below 740 is most unlikely, but would warn of trend weakness.

* Target calculation: 740 + ( 740 – 680 ) = 800

TSX 60 VIX below 15 also reflects low market risk.

The bearish divergence gives a very strong indication to get out as it did 5 years ago! Your comments?

Here is the current divergence:

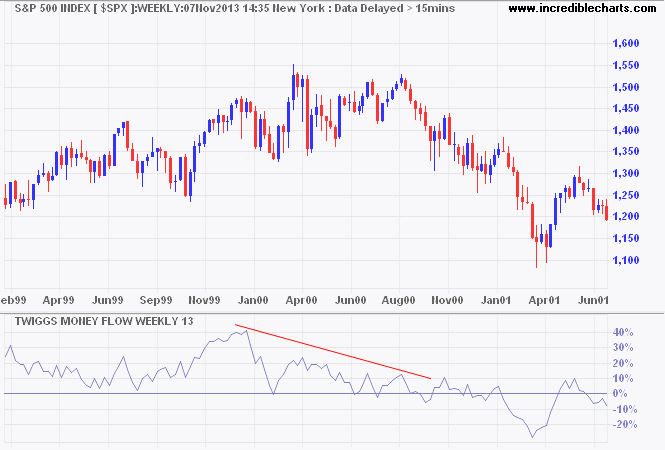

Here is the one before the Dotcom crash in 2000:

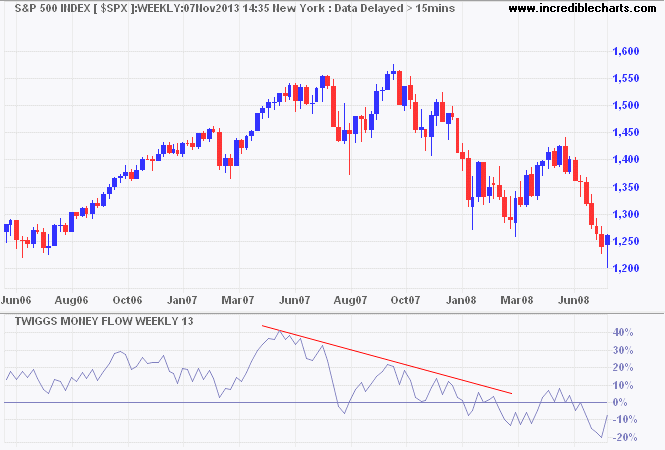

Here is the divergence in 2007:

The last two are far more severe than the current pattern, with dips crossing below the zero line. To me, this looks more like a correction than a reversal.