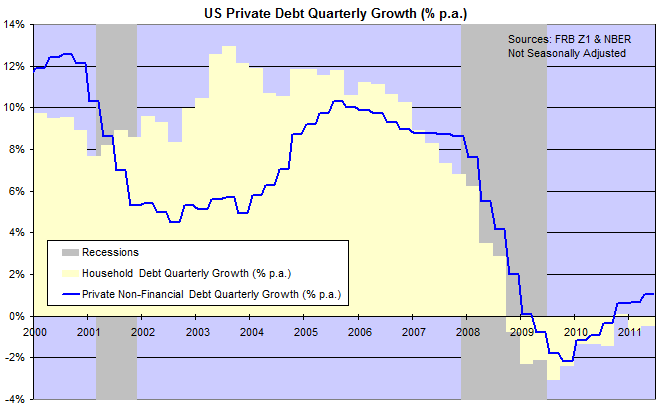

US commercial bank loans and leases bottomed in April 2011, after shrinking more than $1 trillion in the previous two years. The annual rate-of-change has now recovered to positive territory, relieving downward pressure on asset prices, including stocks and real estate. Deleveraging has come to an end and is only likely to resume if the economy suffers further financial shocks.

You would expect the gap between savings and investment to close when net debt repayments cease, but a significant shortfall between Gross Private Savings and Domestic Investment warns of continued instability.

The Investment – Savings gap is reflected by strong, negative Net Private Investment on the chart below. If it were not for the fiscal deficit, the US would risk a significant contraction in national income.

For the benefit of those who may have missed my earlier coverage of this issue:

Debt repayment after a financial crisis/balance-sheet recession creates a gap between savings and investment that has serious implications for the economy. The resultant shortfall between spending and income risks a sharp contraction in national income. The gap may be relatively small but, like a puncture in a car tire, the impact can be huge. It only takes each of us to withhold 2% of what we earn (e.g. to repay debt) for a gap to appear between spending and income. A for example may earn $1.00 but now only pays 98 cents to B, who will pay 96.04 cents to C, who will pay 94.12 cents to D, and so on through the entire supply chain. By the time we get to L, they will only earn 80 cents where they previously earned $1.00.

The solution, as Keynes pointed out, is for government to offset the shortfall by running a fiscal deficit. The chart above shows that Treasury has been doing exactly that — spending more than they collect by way of taxes — in order to prevent a contraction. The problem is that continual deficits have two serious side-effects. The first is a loss of investor confidence as the ratio of public debt to GDP rises. The second is inflation — if private investment recovers and starts competing with government for ever-scarcer resources. By inflation I do not just mean an increase in the CPI, but also rising asset prices as experienced in the 2004 to 2008 housing bubble, when government ran a deficit while net private investment was positive.

As the chart shows, the fiscal deficit is being funded by net savings (plus a little help from China). So what would happen if we cut the deficit?

- An optimistic view would be that cutting the deficit would restore confidence and encourage more private investment, shrinking the savings – investment shortfall.

- Pessimists, however, would warn that private sector balance sheets have been impaired by falling asset prices and investors are reluctant to borrow even at current low interest rates. A shrinking deficit without a counter-balancing rise in investment would send the US back into recession.

The truth lies somewhere in between. Corporate balance sheets are generally in good shape while small-to-medium business and home-owners have suffered significant impairment. And one of the major factors inhibiting investment is the uncertain political/economic environment.

Deleveraging has ended and the time has come to start cutting back the government deficit — but cautiously. Cutting the entire deficit in one hit would be more of a shock than the economy could bear, but setting out a four-year plan to cut the deficit by say 2 percent a year would do a lot to restore confidence and set the economy on a path to recovery.

Hi Colin,

There is rumours of a possible QE3 from America focusing mainly on infrastructure projects… if this were to happen would this add to the governments deficit. i.e did QE1 and QE2 directly increase the US Governments debt?

Also this may be abit off topic but what is the single biggest contributor to US Government Debt?

Kind regards

S Mazey

QE is Fed purchases of Treasuries to fund the deficit — it does not create the deficit.

The sole contributor to Government debt is the deficit, and the deficit is caused by government spending in excess of tax revenues. No specific item of govt. spending can be attributed to the deficit — it is the excess.

I don’t believe that deleveraging is over, as there is huge leveraging still in the Banking industry, particularly in Europe.

My observation was specific to the US. I would be interested to see comparative figures for the EU.

The housing market has not finished deleveraging. As for a shock to the financial system, would a Euro crisis meet that definition? We could be looking at a retrace because our government is not interested in responsible actions that would allow structural repair of the economy, just in getting re-elected by pandering to their constituents.

The last Z1 Flow of Funds (Q2) showed the contraction of household debt slowing since early 2010 but still negative, while overall private non-financial debt growth is now positive. The next report is due out in December.

Your Keynesian observation that government should run a fiscal deficit is true in theory but, by the same token, they should also increase taxes during the recovery in order to bring the system back into balance. But what politician has the intellectual fortitude and/or courage to raise taxes when they should? Result: just look around you ……!!!1

Rhetorical question: What politician is going to go in to an election with a promise to raise taxes — unless it is getting the rich to pay their “fair share”?

With America $120 Trillion in the hole with unfunded obligations that’s $1.3 milli9on per taxpayer. How long will it take by adding $1.3 trillion a year to debt until we can’t pay the interest on the debt…

The honest truth is that we are broke as a nation…we have twice the debt to our assets and there are no good answers to get out of this..only increasingly painful ones as we continue this insanity.

It’s not as bad as it looks — provided politicians have the intestinal fortitude to cut benefits.

Our economy is built on people buying things they don’t need. I can survive in a shed with some beans if I have to. I don’t need all the other stuff, but I buy it cause I want it.

If ordinary people are broke they cut back to buying the essentials and the economy contracts.

There is huge demand for higher wages (from low income wokers) all round the world right now. If the average world wage went up by 1% more than inflation how much of a boost would that be to consumer spending in dollar terms? How many jobs would that consumer boost create.

If the average wage continues to fall relative to inflation will we continue to see the major economies rely on money printing for the illusion of growth? Should investors be handed artifical asset growth, from government intervention, in a time of stagnant wealth creation?

I reckon a government policy of rising wages and low inflation is the cure. More poor people buying more products equals more company profits and more jobs to meet the growing demand. Not sure how to affect this with all the corruption in the world governments tho. The idiots want the working poor to get poorer!

Unfortunately you can’t have your cake and eat it: higher wages cause inflation.

higher wages CANNOT cause inflation…it is the RESULT of inflation. Inflation is ONLY caused bt governments and REAL higher wages are only caused by increases in productivity of the private sector. Of course an individual working for the government may find this difficult to understand.

It depends on how you define inflation. Governments debase the currency. The result is inflation. Rising consumer prices lead to higher wage demands which lead to higher consumer prices. I accept that increases in productivity can also lead to higher wages, but Eddie was not referring to productivity increases.

Wages have been flat for a while now but inflation seems to be growing strongly inspite of this. I think inflation is caused by the government policy of protecting asset values at any cost more than it is caused by rising wages. Don’t higher wages cause an increase in demand which would cause an increase in production also, making supply more efficent giving producers room to sell for lower margins, which would also create demand for labour and lower the unemployment at the same time? Scarce goods would of course get more expensive if everybody wanted them, but not all goods are scarce and our current levels of production are way down on what they could be if everybody was working.

As Jon pointed out, increased productivity can lead to higher wages. Increasing wages without productivity gains would lead to higher inflation. Higher commodity prices also cause inflation, and these are often the result of government debasing the currency (printing money/QE).

An increase in productivity can only come from an increase in demand for the goods being produced, otherwise no business owner in their right mind will increase productivity. (sorry for my anger). If wages are increased then demand will increase and so will productivity. Otherwise you have to make money cheaper to borrow to get the demand going again, but this eventually leads to debt saturation and stops working. Free markets fail because humans are social beings and not selfish consumption machines.

Question for John,

Whats comes first? The chicken or the egg?? Is inflation caused by higher wages or higher wages caused by inflation?