The ASX 200 dipped below primary support at 5650, signaling a primary down-trend. A Trend Index peak at the zero line warns of strong selling pressure. The market is still open, and a lot can happen by the close, but the prospect of a bear market is now close at hand. Expect retracement to test the new resistance level but respect would confirm a bear market, offering a target of 5000.

The two largest sectors are already in a primary down-trend.

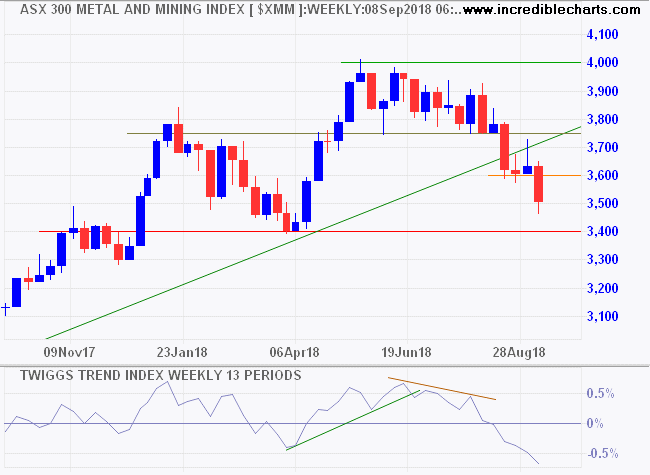

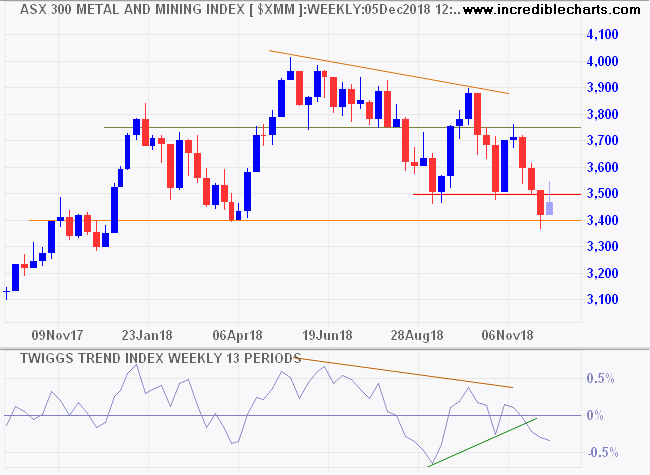

ASX 300 Metals & Mining Index broke support at 3500, signaling a decline with a target of 3100.

The ASX 300 Banks Index, in a down-trend since 2015, is currently testing long-term support at 7000. Breach would offer a target of 5000.

I have been cautious on Australian stocks, especially banks, for a while, and hold 40% cash in the Australian Growth portfolio.