This time it’s not the Russian bear but stock market bears that we need to beware of. Signals across global markets warn of a major down-turn.

North America

The S&P 500 respected resistance at 2000, the false break warning of a bull trap. A 21-day Twiggs Money Flow peak just above zero indicates (medium-term) selling pressure. Recovery above 2000 is unlikely, but would signal a relieving rally. Breach of support at 1870 would confirm the primary down-trend.

* Target calculation: 1900 – ( 2000 – 1900 ) = 1800

The CBOE Volatility Index (VIX) is holding above 20, indicating elevated market risk.

NYSE short sales spiked up close to 1.2 billion on Friday, September 18th.

13-Week Twiggs Money Flow crossed below zero on the (S&P 500) weekly chart, warning of a primary down-trend.

Dow Jones Industrial Average is testing support at 16000. Decline of 13-week Twiggs Money Flow below zero warns of a primary down-trend. Breach of 16000 would confirm the signal.

Canada’s TSX 60 retreated below 790, confirming a primary down-trend. Declining 13-week Twiggs Momentum below zero strengthens the signal.

* Target calculation: 800 – ( 900 – 800 ) = 700

Europe

Germany’s DAX retreated below support at 10000. Decline of 13-week Twiggs Money Flow below zero again warns of a primary down-trend.

The Footsie is in a similar position, with 13-week Twiggs Money Flow below zero. Breach of support at 6000 would confirm a primary down-trend.

Asia

The Shanghai Composite Index continues to test (government-backed) support at 3000. Recovery above 3500 is most unlikely. Breach of 3000 would warn of a sharp sell-off.

Hong Kong’s Hang Seng Index bear rally failed and the index is again testing support at 21000. Breach would confirm the primary down-trend signaled by 13-week Twiggs Money Flow.

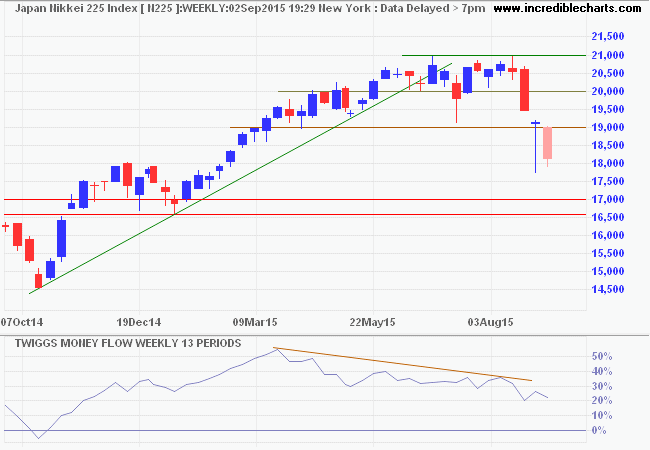

Japan’s Nikkei 225 is having difficulty breaking resistance at 19000. Gradual decline on 13-week Twiggs Money Flow suggests medium-term selling pressure, but reversal of 13-week Momentum below zero warns of a primary down-trend.

* Target calculation: 17500 – ( 19000 – 17500 ) = 16000

India’s Sensex respected resistance at 26500. Reversal below 25000 would confirm a primary down-trend. 13-Week Twiggs Money Flow holding above zero indicates medium-term buying pressure.

But 13-week Twiggs Momentum below zero warns of a primary down-trend.

* Target calculation: 25000 – ( 26500 – 25000 ) = 23500

Australia

The ASX 200 also displays medium-term buying pressure, with rising 21-Day Twiggs Money Flow. But this is unlikely to withstand global bearish forces. Breach of 5000 would confirm a primary down-trend. Recovery above 5300 is most unlikely, but would indicate a bear rally.

* Target calculation: 5000 – ( 5400 – 5000 ) = 4600

More….

Gold: No safety here

Crude at $30 per barrel?

Deflation supercycle is over as world runs out of workers | Telegraph

Australia: Latest SMSF statistics | FINSIA

Deleveragings go on for about 15 years. The process of raising debt relative to incomes goes on for 30 or 40 years, typically. There’s a last big surge, which we had in the two years from 2005 to 2007 and from 1927 to 1929, and in Japan from 1988 to 1990, when the pace becomes manic. That’s the classic bubble. And then it takes about 15 years to adjust.

~ Ray Dalio, Bridgewater Associates