Brexit

No one knows what the outcome of Brexit will be but, whatever the outcome, it is unlikely to send global markets into a tail-spin. There is bound to be short-term pain on both sides but the long-term costs and benefits are unclear.

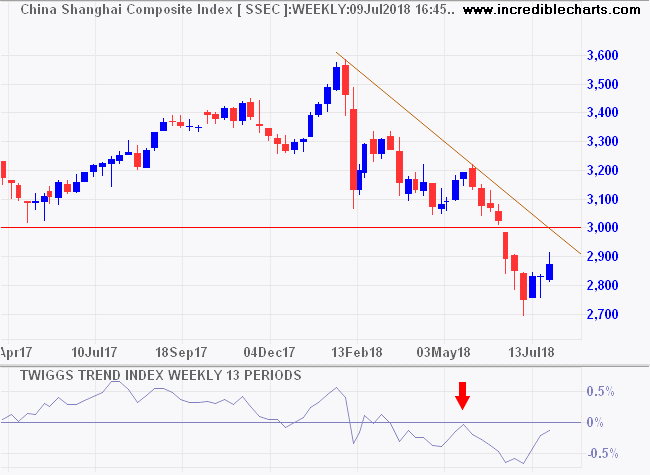

China

Far more likely to send investors scuttling for shelter is a ‘no deal’ outcome on US trade negotiations with China. I would be happy to be proved wrong but I believe that a deal is highly unlikely. There may be press photos with beaming officials shaking hands and tweets from the White House promising a rosy future for all (with or without a wall). But what we are witnessing is not straight-forward negotiations between trading partners, which normally take years to resolve, but a hegemonic power struggle between two super-powers, straight out of Thucydides.

Thucydides wrote “When one great power threatens to displace another, war is almost always the result.” In his day it was Athens and Sparta but in the modern era, war between great powers, with mutually assured destruction (MAD), is most unlikely. Absent the willingness to use military force, the country with the greatest economic power is in the strongest position.

One of the key battlefronts is technology.

“China is now almost wholly dependent on foreign chipsets. And that makes leaders nervous, especially given a series of actions by foreign governments to limit the ability of Huawei and ZTE to operate internationally and acquire Western technology.” ~ Trivium China

“To address this risk, President Xi Jinping aims to increase China’s semiconductor self-sufficiency to 40% in 2020 and 70% in 2025 as part of his ‘Made in China 2025’ initiative to modernize domestic industry.” ~ Nikkei

Xi is unlikely to abandon his ‘Made in China 2025’ plans and the US is unlikely to settle for anything less.

USA

The US economy remains robust despite the extended government shutdown and concerns about Fed tightening.

“Federal Reserve officials are close to deciding they will maintain a larger portfolio of Treasury securities than they had expected when they began shrinking those holdings two years ago, putting an end to the central bank’s portfolio wind-down closer into sight.” ~ The Wall Street Journal

This is just spin. As I explained last week. Fed run-down of assets is more than compensated by repayment of liabilities (excess reserves on deposit) on the other side of the balance sheet. Liquidity is unaffected.

Charts remain bearish as the market views global risks.

Volatility is high and a large (Twiggs Volatility 21-day) trough above zero on the current S&P 500 rally would signal a bear market. Retreat below 2600 would strengthen the signal.

Asia

Hong Kong’s Hang Seng Index is in a bear market but shows a bullish divergence on the Trend Index. Breakout above 27,000 would signal a primary up-trend. This seems premature but needs to be monitored.

India’s Nifty has run into stubborn resistance at 11,000. Declining peaks on the Trend Index warn of selling pressure. Retreat below 10,000 would complete a classic head-and-shoulders top but don’t anticipate the signal.

Europe

DJ Stoxx Euro 600 is in a primary down-trend. Reversal below 350 would warn of another decline.

The UK’s Footsie has retreated below primary support at 6900. Declining Trend Index peaks warn of selling pressure. This is a bear market.

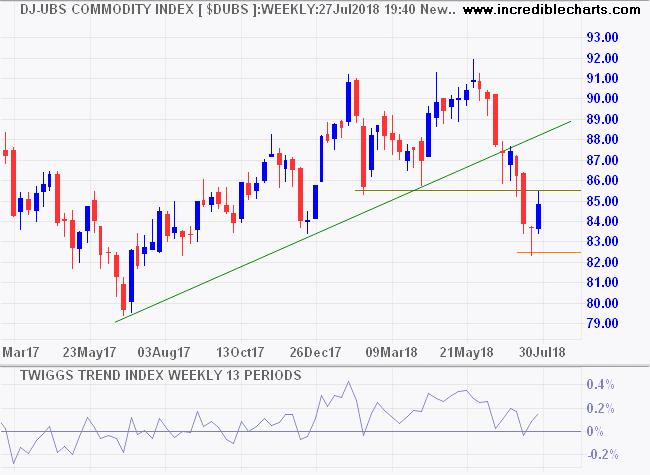

This is a bear market. Recovery hinges on an unlikely resolution of the US-China ‘trade dispute’.

War is a matter not so much of arms as of money.

~ Thucydides (460 – 400 B.C.)