The October labor report shows hours worked were roughly unchanged from September and still 100K below the pre-pandemic high (5.25m). But GDP of 19.5 trillion is up slightly when compared to 19.2T in Q3 2019, indicating that productivity has improved.

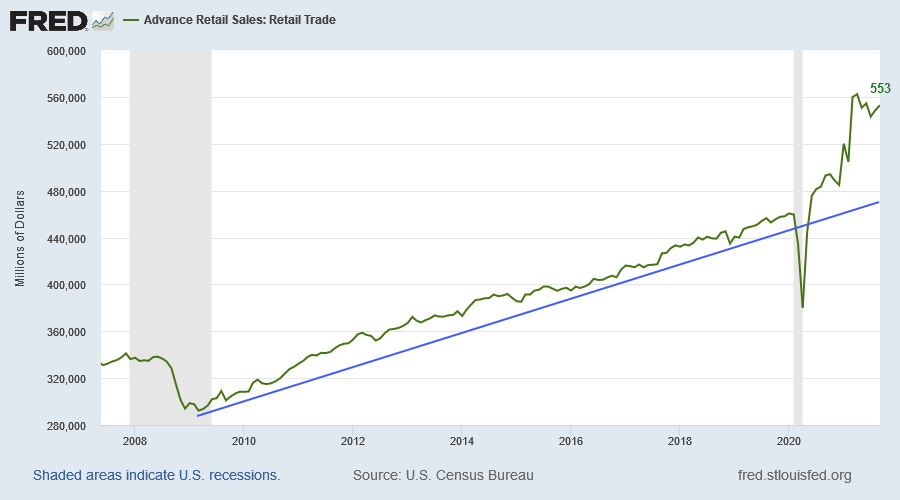

Monthly retail sales for September, on the other hand, were way above trend.

People are spending Dollars they didn’t earn, courtesy of record government stimulus.

That is one of the primary causes of rising consumer prices (red below): when demand outstrips supply.

A rising CPI in turn causes second run inflation through higher wage demands (green and gray above) if central banks fail to act quickly. They become embedded and difficult to dislodge.

The combined effect of the pandemic and government stimulus has had a profound impact on the US labor market. The economy added 5.8 million jobs in the 10 months to October, at an average of 580K per month. That rate is likely to slow as the economy reopens and enhanced unemployment benefits end.

We are missing 4.2 million employees, compared to the pre-pandemic peak of 152.5m jobs, and seem unlikely to find them, judging by the 10.4 million job openings in September. High levels of job openings are likely to exert continuing upward pressure on wages.

The missing workers — aided by government handouts — have either retired, quit their jobs to day-trade Tesla and crypto-currencies, or have re-assessed their work-life priorities. No doubt there will be a trickle back to the workforce — as day-traders encounter reversion to the mean and/or savings run low — but the Fed needs to reassess its full employment target. Failure to do so would leave interest rates too low for too long and allow second run inflation to become entrenched. The only way to then dislodge it is with the kind of drastic measures that Paul Volcker used in the early eighties, with the fed funds rate peaking at 20%.