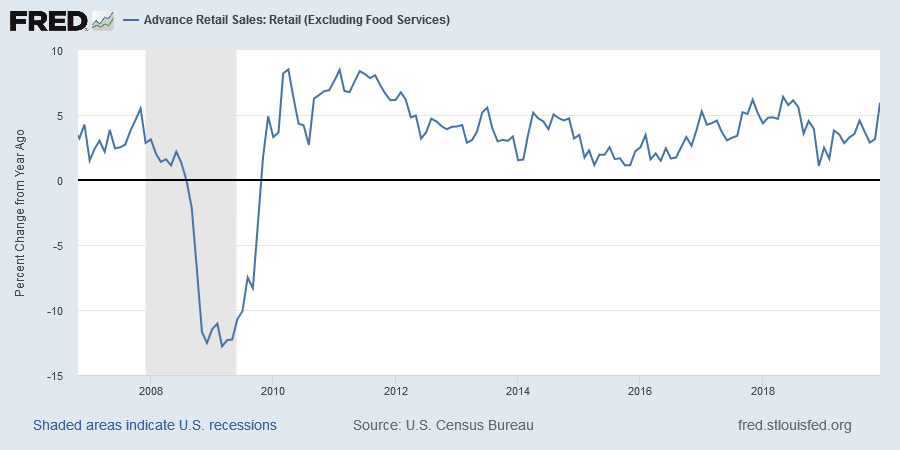

Real retail sales remain strong, holding above the pre-pandemic trend (dotted line) in September.

Supported by a strong jobs market, with low unemployment.

The labor market remains tight, with employers holding on to staff — cutting weekly hours rather than resorting to layoffs.

The consumer sentiment trough in June 2022 coincided with a peak in gasoline prices. Sentiment has been rising over the past 12 months but this could be derailed by a spike in gas prices.

The up-trend in light vehicle sales reflects growing consumer confidence.

The NAHB homebuilder sentiment index (blue below) is falling sharply, however, warning that the recent recovery in new building permits (red) is about to reverse. Residential housing is a major cyclical employer and a collapse of building activity would warn that recession is imminent.

Industry & Transport

Industry indicators show gradually slowing activity but no alarming signs yet. CSBS Community Bank Sentiment index indicates slightly improved business conditions in Q3.

Investment in heavy trucks — a useful leading indicator — remains strong.

Intermodal rail freight traffic — mainly containers — declined in August after a four-month rally. But the longer-term trend is down.

Truck tonnage increased in August for the fifth month but earlier breach of the long-term up-trend (green) warns of weakness ahead.

Manufacturers new orders for capital goods, adjusted by PPI, indicates declining activity which is likely to weigh on future growth.

Conclusion

The tight labor market supports strong consumer spending but high mortgage rates are likely to slow homebuilding activity causing a rise in cyclical employment. A sharp increase in crude oil could also cause higher gasoline prices which would damage consumer sentiment.

Industry and transport activity is gradually weakening but has not yet caused alarm.

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually, then suddenly.”

~ Ernest Hemingway: The Sun Also Rises

Click to play

Click to play