According to market pundits, the latest stock sell-off was fueled by concerns over rising bond yields and slowing growth for Caterpillar (CAT).

From CNBC:

….Caterpillar shares reversed lower during the call, when Chief Financial Officer Brad Halverson said first-quarter adjusted profits per share will be the highest for the year because of increased investment later in 2018.

“We expect the targeted investments for future growth to be higher over the remaining three quarters,” Halverson said. “The outlook assumes that first-quarter adjusted profit per share will be the high-water mark for the year.”

The stock fell 6.2% on Wednesday, ignoring the earnings report:

In the earnings report, the Illinois-based machinery manufacturer raised its 2018 profit outlook by $2 a share over the previous quarter, to a range of $10.25 to $11.25 per share. The rosier guidance exceeds a Reuters analyst survey that expected a range of $8.39 to $10.60 a share. The company cited better-than-expected sales volume as the main driver of its improved full-year guidance.

Since when has “better-than-expected sales volume,” upward earnings revision and increased new investment been a bear signal? The market is unusually jittery at present, focusing on any semblance of bad news and ignoring the good.

Even concern over rising bond yields is nothing new.

10-Year Treasury yields are testing resistance at 3.0%. Breakout would complete a double-bottom reversal, warning of a bear market in bonds as yields rise. But rising long-term rates are not bad news for stocks, especially when off a low base as at present. I would go so far as to say that, over the last 20 years, rising 10-year yields have been bullish for stocks. The chart below compares annual percentage change in 10-year Treasury yields and the Russell 3000 Total Market index.

There is plenty more good news that the market seems to be ignoring.

First quarter 2018 corporate earnings have so far impressed. According to S&P Indices, 117 stocks in the S&P 500 had reported results by the morning of April 24th. Of those, 91 (77.8%) beat, 10 (8.5%) met and 16 (13.7%) missed their estimates. Misses are largely concentrated in Materials ( 3 of 5), Industrials (4 of 26) and Consumer Discretionary sectors (5 of 13).

Freight activity remains strong, signaling a reviving economy.

Wages growth remains tame, with average hourly earnings of production and non-supervisory employees increasing at an annual rate of 2.42%. Growth above 3.0% would warn that underlying inflation is rising and the Fed will be forced to tighten monetary policy. But that does not appear imminent.

Muted wages growth allowed corporate profits (the blue line below) to rebound after a threatened down-turn.

Consumption has recovered. Per capita consumption of non-durable goods is recovering after a flat spot in 2017, consumption of durable goods has been rising since 2016, while services remain strong.

In financial markets, risk premiums on corporate bonds (Baa minus Treasuries) have declined to below 2.0%, suggesting a healthy credit outlook.

Bank credit is recovering after faltering in 2017.

The yield curve is flattening as the Fed gradually raises interest rates. A flat yield curve is not a threat. Only if it inverts, when the yield differential (gray line on the chart below) falls below zero, is the economy at risk of falling into a recession. Growth in the money stock (green MZM line on the chart below) has slowed but remains healthy.

The Fed has committed to shrinking its $4 trillion investment in Treasuries and mortgage-backed securities (MBS) run up by quantitative easing (QE) between 2009 and 2014. So far the decline has had no impact on financial markets as bank excess reserves on deposit at the Fed are declining at a similar rate. The effect is that net assets (Fed Assets minus Excess Reserves) are holding steady at $2.4 trillion.

The Philadelphia Fed’s Leading Index remains healthy at above 1.0 percent.

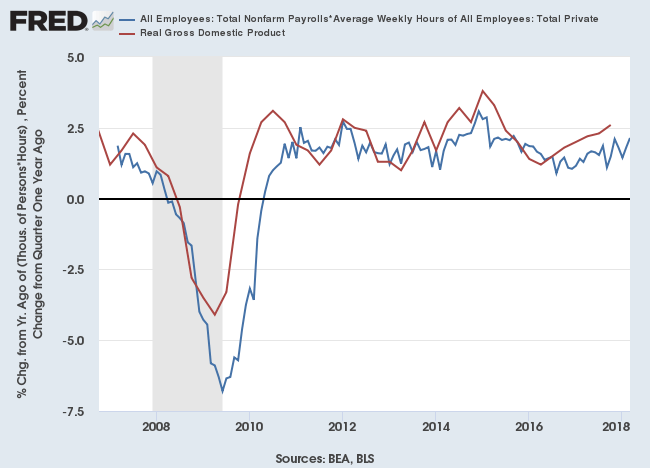

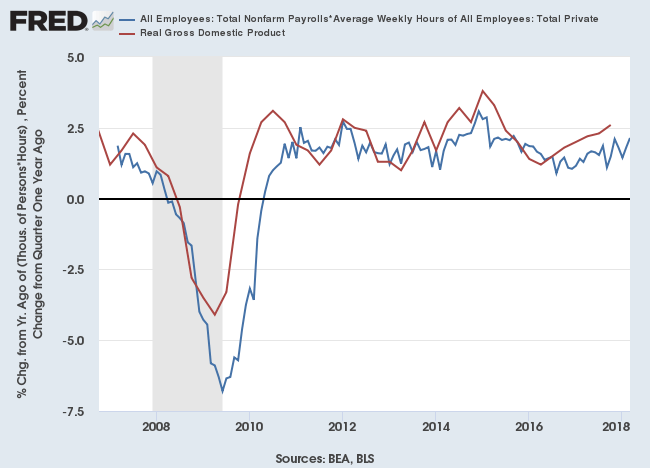

And our estimate of real GDP is rising (2.14% in March 2018), suggesting that the economy is recovering from its flat spot in 2016/2017.

Valuations are high and investors are jittery but the bull market still appears to have further to run.