Robert Shiller’s groundbreaking works, Irrational Exuberance and Animal Spirits, led to a Nobel prize in 2013 but we need to be careful of placing too much reliance on his CAPE as an indicator of stock market value.

What is CAPE?

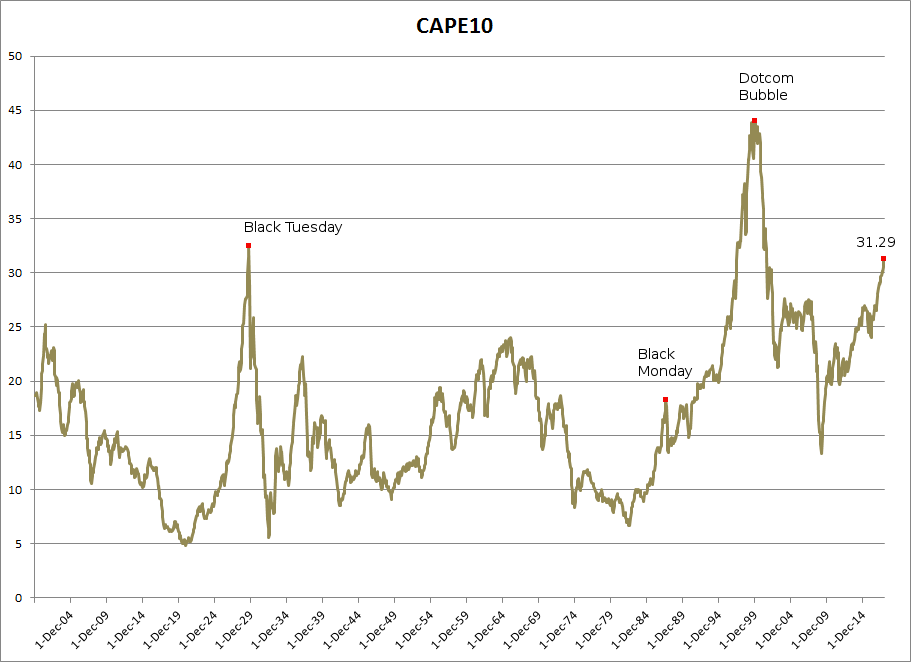

CAPE is the cyclically adjusted price-to-earnings ratio, normally applied to the S&P 500, to assess future performance of equities over the next decade. CAPE is calculated by dividing the S&P 500 index by a moving average of ten years of inflation-adjusted earnings. Higher CAPE values imply poor future returns, while low values signal strong future performance.

Economists John Y. Campbell and Robert Shiller in 1988 concluded that “a long moving average of real earnings helps to forecast future real dividends” which in turn are correlated with returns on stocks. Averaging inflation-adjusted earnings smooths out short-term volatility and medium-term business cycles in the economy and, they argued, was a better reflection of a firm’s long-term earning power.(Campbell & Shiller: Stock Prices, Earnings and Expected Dividends)

Shiller later popularized the 10-year version (CAPE) as a way to value the stock market.

Strengths

CAPE correctly identifies that the S&P 500 was over-priced in the lead-up to Black Friday (October 1929) and ahead of the Dotcom bubble in 2000. It also correctly identifies that stocks were under-valued after the Depression of 1920-21, during the Great Depression of the 1930s, and during the 2008 Global Financial Crisis.

Weaknesses

Some CAPE readings are rather odd. The rally of 1936, in the midst of the Great Depression, shows stocks as overvalued. Black Monday, October 1987, which boasts the highest ever single-day percentage fall (22.6%) on the Dow, hardly features. Current CAPE values, close to 30, also appear exaggerated when compared to current earnings.

Causes

There are several reasons for these anomalies, two of which relate to the use of a simple moving average to smooth earnings.

The simple moving average (SMA) is calculated as the sum of earnings for 10 periods which is then divided by the number of periods, 10 in our case. While the SMA does a reasonably good job of smoothing it has some unfortunate tendencies.

First, the SMA tends to “bark twice. If unusually high or low data is recorded, the SMA will rise or fall accordingly, as it should. But the SMA will also flag unusual activity, in the opposite direction, 10 years later when the unusual data is dropped from the average.

Second, the SMA is fairly unresponsive. If earnings rise rapidly, the SMA will lag a long way behind current values.

The third anomaly relates to the use of a moving average of earnings to reflect future earnings potential. Companies may incur losses at the low-point in the business cycle, especially in a severe down-turn like 1929 or 2008, but the impact on future earnings capacity is marginal.

Take a simplistic example, where earnings are $1 per year for 9 years but a loss of $5 is incurred in the following year. When the business cycle recovers, potential earnings are likely to be $1, not $0.50 (the 10-year SMA).

Examples

All of these flaws are evident in the CAPE chart above.

Problem 1

Expect a fall in CAPE next quarter (Q1 2019) when losses from Q4 2008 are dropped from the SMA period.

Problem 2

Earnings multiples in the lead-up to Black Friday (1929) and the DotCom bubble (2000) are both overstated because of the lag in the SMA caused by rapidly rising earnings.

Problem 3

Potential earnings in 1936 are understated because of the sharp fall in earnings during the Great Depression, resulting in an overstated earnings multiple. The same situation occurs 2009-2018 when losses from 2008 inflate CAPE values.

Proposed Solution

I tried a number of different moving averages in order to avoid the above anomalies but all, to some extent, presented the same problems.

Eventually, I tried dropping the moving average altogether, instead using the highest previous four consecutive quarter’s earnings to reflect future earnings potential. I call this PEmax © (price over maximum historic earnings). PEmax matches normal historic price-earnings ratio (PE) most of the time, when earnings are growing, but eliminates the distortion caused by sharp falls in earnings near the bottom of the business cycle.

PEmax overcomes distortions associated with the 1936 bear market rally, Black Monday in 1987 and our current situation in 2018.

Compare how the two perform on a single chart below.

The spikes on Black Friday and the Dotcom bubble are more muted on PEmax but still warn that stocks are over-priced relative to future earnings potential. The 1936 bear market rally is restored to its proper perspective. As is the 1987 Black Monday spike, by removing the distortion caused by declining earnings in the early 90s. The same happens after the Dotcom bubble. And again in 2009 -2018.

Potential Uses

The historic average (1900 – 2018) for PEmax is 12.79. For what it’s worth, standard deviation is 5.32 but this is not a normal distribution.

The median (middle) value is slightly below the mean, at 12.23.

Visual inspection of the data suggests that low values are skewed towards the first half of the 20th century. The average over the last 50 years (1969-2018) is 15.85 but, again, this may be distorted by the Dotcom era.

Based on visual inspection, we suggest using a PEmax of 15.0 as the watershed:

- PEmax greater than 15.0 indicates that stocks are over-priced; while

- PEmax below 15.0 presents buying opportunities.

Potential Weaknesses

PEmax has one potential weakness. If S&P 500 earnings are ever exaggerated by an unusual event, to a level that is unlikely to be repeated, potential earnings will be overstated and PEmax understated. Fortunately, that is likely to be a rare occurrence, where earnings for the entire index spike above actual earnings capacity.

Conclusion

PEmax ©, an earnings multiple based on the highest previous four consecutive quarter’s earnings, is a useful comparison of price to future earnings potential. It eliminates many of the distortions traditionally associated with price-earnings multiples, including CAPE. High PEmax values (above 15) suggest poor future performance, while low PEmax values (below 15) correspond with greater investment opportunity.