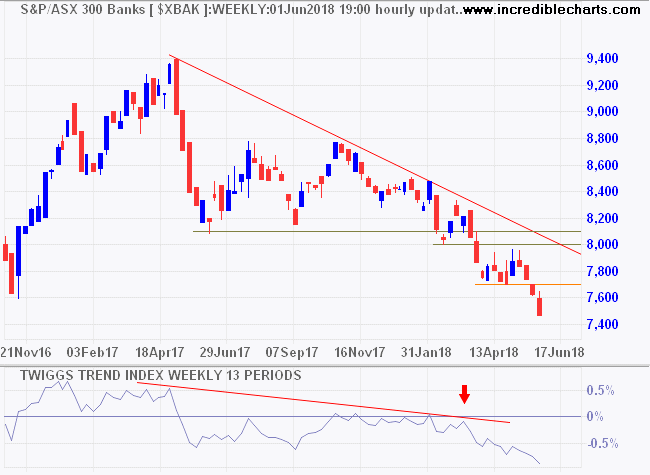

The ASX 300 Banks index continues to test resistance at 8000. Respect remains likely and would indicate another test of primary support at 7300.

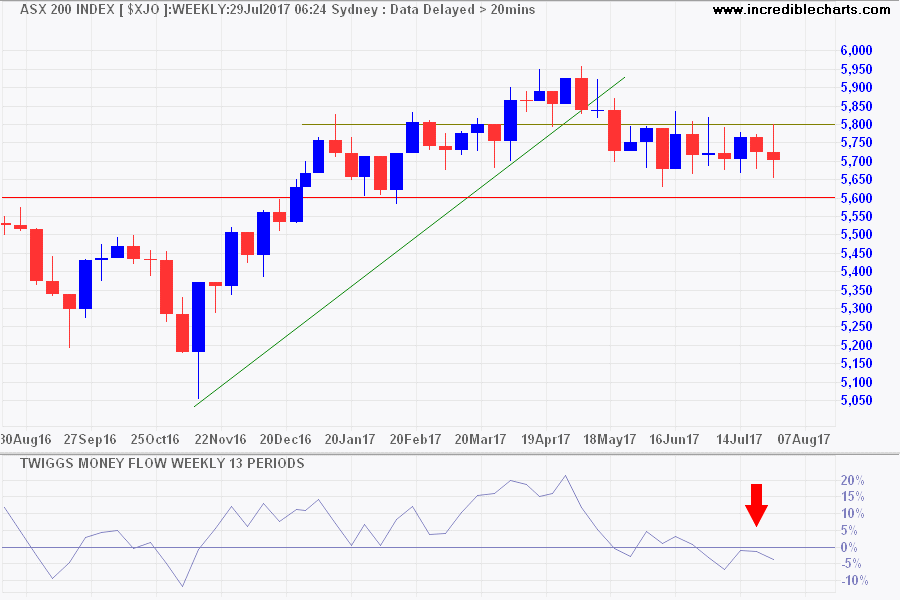

Rising banks lifted the ASX 200. Follow-through above 6250 signals another primary advance, with a target of the October 2007 high at 6750.

This leaves me in a difficult position. Technical signals suggest a primary advance, while economic indicators warn of rising headwinds and a potential bear market.

Banks

The banking sector is being squeezed by higher funding costs, falling credit growth and rising default risk.

Gerard Minack from Minack Advisers warns that the current credit contraction could cause a significant fall in housing prices:

Most houses are bought on credit, so the demand for housing is a function of the supply of credit. Consequently, housing loan approvals have historically led house prices. New loan approvals have fallen by around 20% year-over-year several times over the past 25 years. If the current credit contraction is more severe – say, a decline of up to 30% – then nationwide house prices could fall high single digits over the coming year.

….All this suggests that a high single-digit decline in house prices would put a material dent in domestic demand. If prices were to fall by, say, 15%, and if consumer income growth was as tepid as it now is, there would be a good chance of recession.

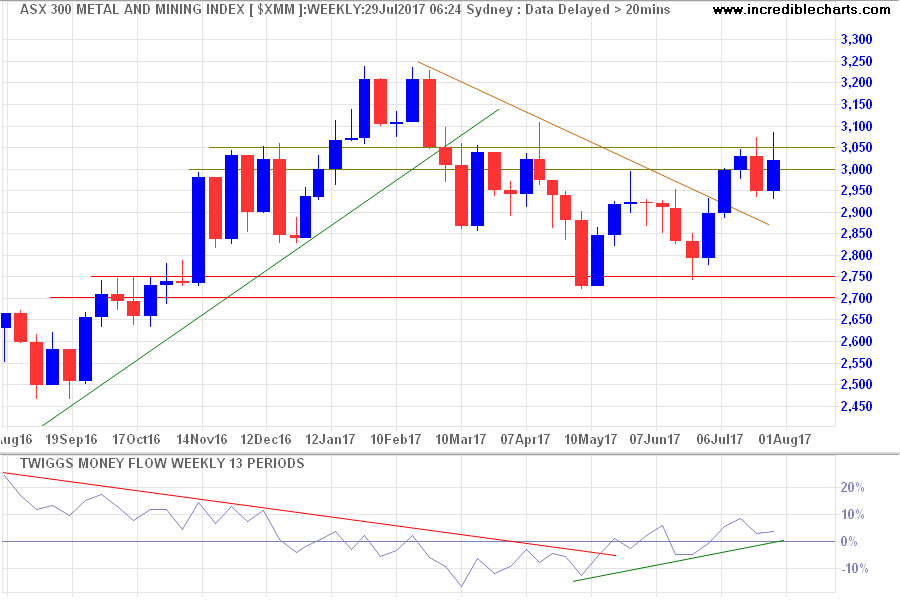

Resources

A falling Chinese Yuan highlights the threat of trade tariffs to the Chinese economy.

Commodity prices have responded, falling to test primary support levels.

Including iron ore.

The ASX 300 Metals & Mining index is testing medium-term support at 3800. Breach is likely and would warn of a correction to test the rising trendline.

My approach is to sit with one foot either side of the fence. Focus on growth sectors. Stay away from Banks. Stay away from Resources but stay in Gold. And keep a healthy percentage of the Australian portfolio in Cash and reasonably secure interest-bearing investments. Definitely not hybrids.