Stocks: Evolution Mining, Northern Star Resources, Regis Resources, St Barbara

Symbols: EVN, NST, RRL, SBM

Exchange: ASX

Date: July 19, 2018

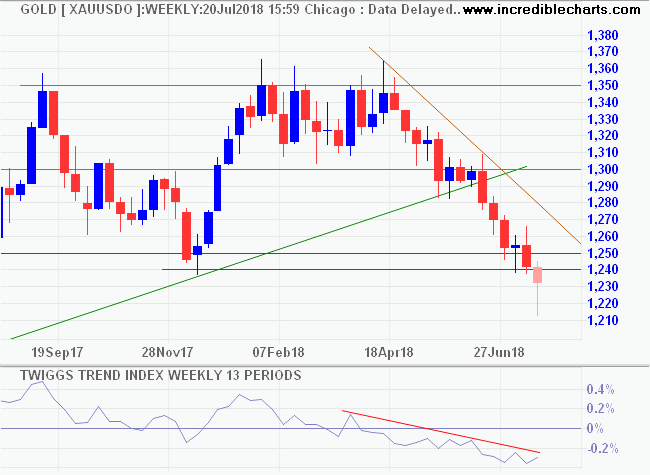

The Dollar price of gold has broken support at $1240/ounce, signaling a primary down-trend.

The Dollar Index continues to test resistance, consolidating in a narrow band below 95, a bullish sign. Chinese selling of the Dollar, to support the Yuan, has not materialized in sufficient magnitude to reverse Dollar strength. Breakout above 95 would spur selling of gold.

The Australian Dollar has not weakened sufficiently to protect local gold miners. The All Ordinaries Gold Index (XGD) is heading for a test of support at 4900/4950. Given the circumstances, support is unlikely to hold.

Bearish divergence on 21-day Twiggs Money Flow warns of selling pressure across all four gold stocks in the Australian Growth portfolio.

Evolution (EVN) is the weakest, having broken primary support at $3.10.

Northern Star (NST) broke medium-term support at $7.00 but is still in an up-trend. LT bearish divergence on Money Flow warns of selling pressure.

Regis Resources (RRL) respected medium-term support at $4.90 but Money Flow peaks below zero warn of strong selling pressure.

St Barbara (SBM) respected its rising trendline but Money Flow also warns of selling pressure.

Conclusion

I don’t like the idea of holding gold stocks long-term when the USD price of gold is in a primary down-trend. Now is a good time to lock in profits from the last 6 months.

SELL (July 19, 2018)

Disclosure

Staff of The Patient Investor may directly or indirectly own shares in the above companies.