Australian newsreader Waleed Aly deconstructs ISIS on Channel Ten – The Project.

Hat tip to David Llewellyn-Smith at Macrobusiness.com.au.

Australian newsreader Waleed Aly deconstructs ISIS on Channel Ten – The Project.

Hat tip to David Llewellyn-Smith at Macrobusiness.com.au.

Crude futures (Light Crude December 2015 – CLZ2015) are testing support at $44.50 per barrel. Follow-through below $44.00 would signal another test of primary support at $40. Supply continues to exceed demand with the Saudis and Russians cranking up production and cutting prices to secure key markets in the US and China. Breach of $40 would offer a (long-term) target of $30*. Recovery above $50 per barrel is most unlikely unless there is a serious disruption to supply.

* Target calculation: 40 – ( 50 – 40 ) = 30

Dalan McEndree writing in Oilprice.com :

While the sharp decline in crude prices has saved crude consuming nations hundreds of billions of dollars, the loss in revenues has caused crude exporting countries intense economic and financial pain. Their suffering has led some to call for a change in strategy to “balance” the market and boost prices. Venezuela, an OPEC member, has even proposed an emergency summit meeting.

In practice, the call for a change is a call for Saudi Arabia and Russia, the two dominant global crude exporters, which each daily export over seven-plus mmbbls (including condensates and NGLs) and which each see the other as the key to any “balancing” moves, to bear the brunt of any production cuts…….

Despite the intense pain they are suffering in the low price Crudedome, both the Russian and Saudi governments profess for public consumption that they are committed to their volume and market share policies.

This observer believes the two countries cannot long withstand the pain they have brought upon themselves — and this article only scratches the surface of the negative impact of low crude prices on their economies. They have, in effect, turned no pain no gain into intense pain no gain and set in motion the possibility neither will exit the low price Crudedome under its own power.

Read more at Oil market showdown: can Russia outlast the Saudis? | Oilprice.com

Shades of Churchill in 1938:

Winston Churchill, denouncing the Munich Agreement in the House of Commons, declared:

“We have suffered a total and unmitigated defeat … you will find that in a period of time which may be measured by years, but may be measured by months, Czechoslovakia will be engulfed in the Nazi régime. We are in the presence of a disaster of the first magnitude … we have sustained a defeat without a war, the consequences of which will travel far with us along our road … we have passed an awful milestone in our history, when the whole equilibrium of Europe has been deranged, and that the terrible words have for the time being been pronounced against the Western democracies: “Thou art weighed in the balance and found wanting”. And do not suppose that this is the end. This is only the beginning of the reckoning. This is only the first sip, the first foretaste of a bitter cup which will be proffered to us year by year unless by a supreme recovery of moral health and martial vigour, we arise again and take our stand for freedom as in the olden time.”

On 3 October 1938, Churchill added:

“England has been offered a choice between war and shame. She has chosen shame, and will get war.”

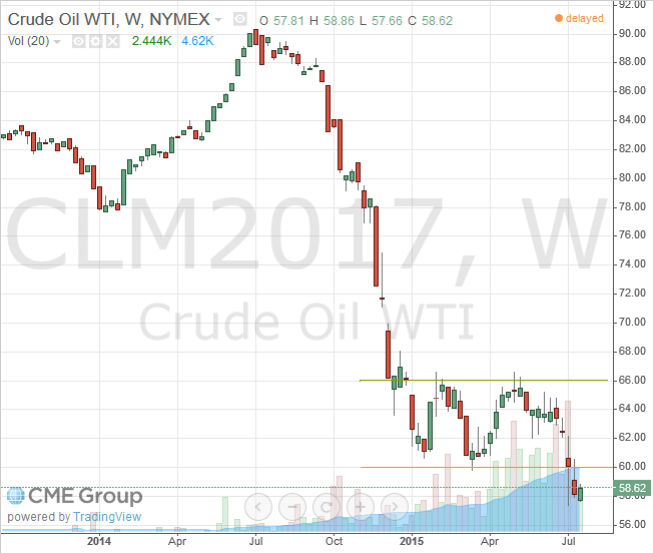

Long-term June 2017 Nymex Light Crude futures (CLM2017) broke support at $60/barrel, offering a target of $54/barrel*.

* Target calculation: 60 – ( 66 – 60 ) = 54

In the short-term, September 2015 futures (CLU15) are testing support at their March low of $50/barrel. Breach is likely, given the long-term down-trend, and would offer a target of $40/barrel*.

* Target calculation: 50 – ( 60 – 50 ) = 40

Declining prices will hurt the Energy sector in the short/medium-term, but the benefit to the broader economy will outweigh this in the longer term. Lower fuel prices will especially benefit the Transport sector. Highly industrialized exporters like Germany, Japan, China and the broader EU, will also benefit. While oil exporters like Russia, Iran, the Middle East, Nigeria, Angola, Venezuela, and to a lesser extent Norway, face hard times ahead.

Nymex light crude (April 2015 contract) broke support at $45/barrel, warning of a decline to $35/barrel*.

* Target calculation: 45 – ( 55 – 45 ) = 35

By Houses & Holes

Reproduced with kind permission from Macrobusiness.com.au

From Jeremy Grantham:

The simplest argument for the oil price decline is for once correct. A wave of new U.S. fracking oil could be seen to be overtaking the modestly growing global oil demand.

It became clear that OPEC, mainly Saudi Arabia, must cut back production if the price were to stay around $100 a barrel, which many, including me, believe is necessary to justify continued heavy spending to find traditional oil.

The Saudis declined to pull back their production and the oil market entered into glut mode, in which storage is full and production continues above demand.

Under glut conditions, oil (and natural gas) is uniquely sensitive to declines toward marginal cost (ignoring sunk costs), which can approach a few dollars a barrel – the cost of just pumping the oil.

Oil demand is notoriously insensitive to price in the short term but cumulatively and substantially sensitive as a few years pass.

The Saudis are obviously expecting that these low prices will turn off U.S. fracking, and I’m sure they are right. Almost no new drilling programs will be initiated at current prices except by the financially desperate and the irrationally impatient, and in three years over 80% of all production from current wells will be gone!

Thus, in a few months (six to nine?) I believe oil supply is likely to drop to a new equilibrium, probably in the $30 to $50 per barrel range.

For the following few years, U.S. fracking costs will determine the global oil balance. At each level, as prices rise more, fracking production will gear up. U.S. fracking is unique in oil industry history in the speed with which it can turn on and off.

In five to eight years, depending on global GDP growth and how quickly prices recover, U.S. fracking production will start to peak out and the full cost of an incremental barrel of traditional oil will become, once again, the main input into price. This is believed to be about $80 today and rising. In five to eight years it is likely to be $100 to $150 in my opinion.

U.S. fracking reserves that are available up to $120 a barrel are probably only equal to about one year of current global demand. This is absolutely not another Saudi Arabia.

Saudi Arabia has probably made the wrong decision for two reasons:

First, unintended consequences: a price decline of this magnitude has generated a real increase in global risk. For example, an oil producing country under extreme financial pressure may make some rash move. Oil company bankruptcy might also destabilize the financial world. Perversely, the Saudis particularly value stability.

Second, the Saudis could probably have absorbed all U.S. fracking increases in output (from today’s four million barrels a day to seven or eight) and never have been worse off than producing half of their current production for twice the current price … not a bad deal.

Only if U.S. fracking reserves are cheaper to produce and much larger than generally thought would the Saudis be right. It is a possibility, but I believe it is not probable.

The arguments that this is a demand-driven bust do not seem to tally with the data, although longer term the lack of cheap oil will be a real threat if we have not pushed ahead with renewables.

Most likely though, beyond 10 years electric cars and alternative energy will begin to eat into potential oil demand, threatening longer-term oil prices.

Exactly right, though in my view the equilibrium price will be more like $50 than $30 for the next half decade.

Don’t miss the full report.

Sohrab Rahmaty makes a strong case for changing the strategy to control illicit opium production in Afghanistan:

….In the 1970s, Turkey was a major source of illicit opium for the drug trade. In just four years, and with the help of an American-led initiative, Turkey was able to transform its illegal opium trade into a viable and profitable legal industry. The Turkish government instituted a program that offered to license farmers’ crops for medical purposes, resulting in Turkey becoming a leader in the opiates-based medical field. There is no reason why Afghanistan should not pursue a similar path….

The cost of establishing a legitimate industry would be a fraction of the cost of “containment” of the illicit industry and would also strengthen central government control over outlying regions.

Read more at A Solution for Afghanistan’s Opium Crisis? | The Diplomat.

“The current fall in price does nothing to offset the squeeze on the total economy from rising costs,” Grantham writes. “It merely transfers massive amounts of income from one subgroup (oil producers) to another (oil consumers), in a largely zero-sum game….”[Business Insider]

The above quote from Jeremy Grantham made me do a double-take. His “largely zero-sum game” refers to the global playing field. Oil producers such as the Saudis, Russia, Venezuela, Nigeria and Iran will earn less per barrel, while oil consumers like China and the EU will gain an equivalent amount per barrel. More importantly, oil consumers will receive a substantial boost to their economies. The “zero-sum game” assumes that crude production will remain constant. But consumption is likely to rise significantly as plunging oil prices deliver more savings to consumers, providing a massive stimulus to local economies. That in turn will lead to increased production of crude oil. A win-win for producers and consumers.

The Nymex Light Crude monthly chart shows a breach of long-term support at $75/barrel. Brent crude is in a similar down-trend. Target for the (WTI) decline is $40/barrel*.

* Target calculation: 75 – ( 110 – 75 ) = 40

Plunging prices may slow the establishment of new wells, but existing wells are likely to continue pumping as long as the price per barrel of crude is higher than the marginal cost. Marginal costs ignore sunk (or fixed) costs like exploration and establishing a new well. They are merely the variable costs that would be saved — like wages and consumables — if production is halted. Marginal costs are far lower than the producers’ total cost and are not yet threatened.

As for the long-term viability of producers at lower prices, the following chart is worth repeating. Prior to the 2005 “China boom”, the ratio of crude prices to CPI oscillated between 0.1 and 0.2. Over the last few years it has soared to between 0.4 and 0.6. A fall back to 0.2 would harm new, marginal producers (i.e. US fracking) but should not affect core producers. Whether governments reliant on “oil-welfare” — like Russia, Iran and Venezuela — are sustainable is an entirely different matter.

Retired army officer John A. Nagl writes:

The United States is now at war in Iraq for the third time in my lifetime, and after being in the middle of the first two I’m planning to sit this one out.

The first Iraq war was necessary and conducted well, as wars go; the second was unnecessary and conducted poorly at first, but ended up in a reasonable place given what a fiasco it had been at the start. This third war was entirely preventable, caused by a premature departure of U.S. troops after the second. Although it’s too soon to say how it will turn out, it is not too early to say that unless we get the endgame right, the United States will fight yet another war in Iraq before too long.

Read more at Get Ready for Iraq War IV.

You must be logged in to post a comment.