The Dollar rally is slowing, with the Dollar Index running into resistance at 93, ahead of the anticipated 95. Penetration of the descending trendline suggests that a bottom is forming. Bullish divergence on the Trend Index indicates buying pressure. Retracement that respects the new support level at 91 would be a bullish sign. Breach of 88.50 is unlikely but would warn of another primary decline.

Rising crude prices weaken Dollar demand.

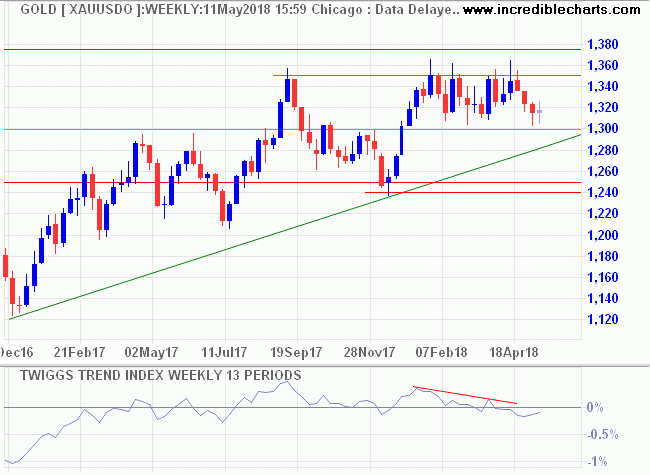

Spot Gold continues to test support at $1300. The declining Trend Index indicates selling pressure and a peak below zero would warn of another test of primary support at $1250/ounce.

Australian gold stocks continue their strong run. Retracement of the All Ordinaries Gold Index that respects the new support level at 5000/5100 would confirm a fresh advance and long-term target of 6000.

A weakening Aussie Dollar, testing support at 75 US cents, is driving local gold prices. Breach of support would offer a long-term target of 69/70 US cents.